Insurance Software Development Company & Services

They’re also notable for their commitment to the software’s ongoing development. It’s not just a case of creating some software, selling it to people and providing ongoing support. Instead, they have a dedicated team of business analysts, architects and quality assurance analysts whose responsibility it is to continue to develop new features and functionality. Applied Systems makes it their mission to spearhead the digital transformation of your business, tapping into new technologies to improve communication.

- Many high-performing insurance businesses use API integrations to keep data in sync, enhance productivity, and drive revenue.

- Find out more about digital strategies and insurance software solutions for P&C insurers.

- Fortunately, modern software solutions overcome these obstacles efficiently and deliver a better insurance experience to customers.

- If you’re pressed for time, we recommend starting with an MVP version of a product that offers its benefits and investing in a full-blown insurance software after a bit.

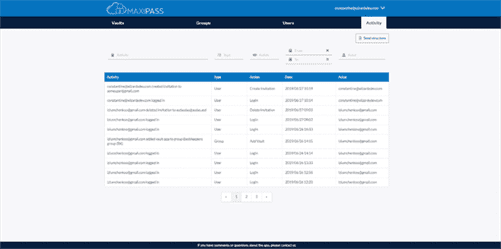

As a majority of insurance software companies, we use Jira and Slack to monitor project progress and developers’ tasks. You will have access to the project’s account, where you’ll be able to track the milestones, progress of each stage, and budget spent on the used tools. Meet global regulatory requirements with an approach that incorporates risk assessments as part of your compliance strategy. Link data, models, systems, and processes between actuarial and accounting functions and review analytical requirements without the need to build integrations between various point solutions.

Payroll processing

Equisoft/centralize streamlines and connects a distributor’s operations with a single back office system that automates time consuming tasks like commission accuracy enforcement and compliance. With our modern, open and cloud-native platforms, you can build strong connections and keep evolving. We are committed to helping you maximize your technology investment so you can best serve your customers. We understand the landscape of your industry and the unique needs of the people you serve.

Business-critical core systems, digital capabilities, and analytics to personalize experiences and make informed decisions, quickly. Who’s doing great and who needs help, not just based on sales Web Development Technology and Software Solutions but what’s in the pipeline. Gain access to policyholders and policies on the go; nurture your insurance database, keep track of important dates and maintain personalized daily action item list.

Why Relevant for Insurance software development services?

You can even bundle different products together and you only have to pay for what you actually use. When it comes to streamlining your workflows, EZLynx is one of the best pieces of software out there. It also offers a tool called Agency Insights, which mines quote data and identifies ways to sell or cross-promote to different targets.

Although companies can fix errors to avoid fines, dealing with the IRS is resource intensive. Ernst & Young’s survey found that errors lead to job cuts, reputational decline and poor employee morale. Roll by ADP is our pick for the best mobile payroll solution because it allows you to run and manage your payroll quickly and easily while on the go. If you know how to send a text, you don’t need special training to use Roll by ADP. You can accomplish most payroll tasks by sending a message to the system and tapping your smartphone or tablet screen a few times.

Related Insurance Software

These features don’t come for free either; you’ll need to pay an extra monthly cost plus a charge per employee. One of Rippling’s biggest strengths is its abundance of features and add-ons that make it a strong payroll software provider. It’s powerful, easy to use, and integrates with hundreds of third-party apps. In addition to its flexibility and the ability to essentially build your own suite, it offers a well-rounded option for business owners. The best payroll software has positive user reviews on customer review sites. Payroll service companies should provide customers with fast and reliable support.

Plus, free payroll apps usually have employee self-service portals to remove some HR and payroll tasks off your to-do list. Online payroll services help companies of all sizes, even if you only pay yourself as the owner. While small firms may feel comfortable handling simple calculations for a handful of workers, things get more complicated as organizations add employees or contractors. Deploying a payroll system improves operations, reduces risks and supports business growth. Additionally, payroll services provide different types of customer support. For example, payroll clients can contact Wave via email and live chat, whereas QuickBooks Payroll offers live chat, callbacks or a toll-free phone number.

Specific or comprehensive

It makes it easier to assess their situations and provide the right quotes. It also ensures that your customers can perform service requests at their convenience. Insurance CRM software with opportunity https://www.globalcloudteam.com/ management feature take this to the next level. By understanding the customer activities on your website, ads, or marketplaces, it sends upsell and cross-sell signals to sales reps and agents.

For example, MasterCard has integrated AI and ML to trace and process variables, including transaction size, location, device, time and purchase data. Increase customer lifetime value by leveraging AI-driven bundling, add-ons, and product extensions that proactively add value to customer experiences. Respond to customers’ needs in real time with the most accurate data that offers a complete view of driver behavior.

Cloud & Operations

This not only improves customer satisfaction, but also encourages on-time payments and stronger relationships. While modern automation scales with changes to billing software and CRM configurations, its ability to grow doesn’t stop there. By trusting automation in all business cases, small businesses can enjoy more time and energy to focus on core business activities, growth, and customer satisfaction. Today’s billing processes running on the latest software invites employees into the process rather than obscuring each step.

Today’s offerings include flexibility for types of currency, methods of collection (credit, debit, ACH, etc.), and error correction. Typically, unpaid tools offer self-service payroll, meaning you must file and remit federal, state and local taxes yourself. However, small businesses and startups with a limited budget can ditch spreadsheets by switching to free payroll software.