Topic No 414, Rental Income and Expenses Internal Revenue Service

In this journal entry, total liabilities on the balance sheet decrease by $5,000 while total revenues on the income statement increase by $5,000. Likewise, the remaining balance of unearned rent is $10,000 (15,000 – 5,000) as of January 31, 2021. If you’re a cash basis taxpayer, you can’t deduct uncollected rents as an expense because you haven’t included those rents in income. For information about repairs and improvements, and depreciation of most rental property, refer to Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

- To summarize, rent is paid to a third party for the right to use their owned asset.

- When a tenant pays rent in advance, they agree to use the underlying property for that period.

- It is common in most rental agreements for the landlord to ask for advance rent.

- Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment, if you rent part of your property, or if you change your property to rental use.

- In this case, you would take $1,000 and divide it by 31 days to get a daily rate of $32.26.

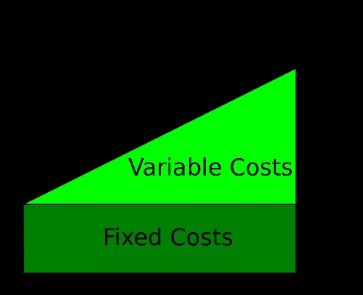

You generally deduct your rental expenses in the year you pay them. Publication 527 includes information on the expenses you can deduct if you rent a condominium or cooperative apartment, if you rent part of your property, or if you change your property to rental use. In the accounting equation, we can see that the transaction of the rent paid in advance increases one asset while decreasing another asset at the same time. Likewise, the transaction of rent paid in advance only occurs on the assets of the accounting equation. Generally, variable, or contingent rent, is expensed as incurred according to both legacy accounting and the new accounting standard.

Advance (Prepaid) Rent: Definition, Journal Entry, Accounting Treatment, Example

When a business does not own a premise to conduct its day-to-day operations, it may hire a property and make periodic payments against it. In the first year, you receive $5,000 for the first year’s rent and $5,000 as rent for the last year of the lease. When the periodic payments are structured so they can not be calculated without the occurrence of an event, such as a number of sales or units produced, the payments are not considered fixed rent. What he said is report the income on schedule E, Then report deferred revenue on expense to offset the expense for 2020. If you report the activity on Sch C – Sole Proprietor/Self Employed business you might have the ability to change from one method (cash) to another (accrual). But you have to file a Form 3115 and do a number of computations and it’s a pain in the butt However, just to be clear, you can’t just up and decide to use the accrual method on a whim.

High rents, scams and paperwork make housing a struggle for international students in Winnipeg – CBC.ca

High rents, scams and paperwork make housing a struggle for international students in Winnipeg.

Posted: Mon, 04 Sep 2023 10:00:00 GMT [source]

If you collect first and last month’s rent from your tenants, you must be transparent about why you’re doing it and ensure your tenants understand the risks involved. If the lease payment is variable the lessee cannot estimate a probable payment amount until the payment is unavoidable. Even if a high certainty the performance or usage the variable lease payment is based on will be achieved does exist, the payments are not included in the lease liability measurement.

How to record prepaid rent correctly

In most circumstances, it encompasses the first and last rent that the tenant must pay. However, some contracts may also require the tenant to pay six months or one year’s rent in advance. As mentioned, nonetheless, some laws may protect tenants against any unjust requirements. Therefore, it includes any amounts paid to use a property for a month. In some cases, these payments must cover the next six months or one year.

Somerville Rent Stabilization Listening Session, September 12 – City of Somerville

Somerville Rent Stabilization Listening Session, September 12.

Posted: Fri, 25 Aug 2023 07:00:00 GMT [source]

At the initial measurement and recognition of the lease, the company is unsure if or when the minimum threshold will be exceeded. Therefore the variable portion of the rent payment is not included in the initial calculations, only expensed in the period paid. The periodic lease expense for an operating lease under ASC 842 is the product of the total cash payments due for a lease contract divided by the total number of periods in the lease term.

When to Report Income

Either way, most lease contracts involve the payment of monthly rent in advance for a specific period. When an advance payment for the rent is made by aws security assurance services the entity, the prepaid rent account is debited and the bank account is credited. However, the benefits are availed in the future accounting period.

Most landlords also require tenants to pay their rents in advance for the use of their property. However, it does not encompass the rents paid for the month immediately following the payment. Then, on January 31, 2021, the company ABC can make the adjusting entry to record the rent expense by transferring the one-month balance of prepaid rent to rent expense with the below journal entry.

Accounting for accrued rent with journal entries

Some lease contracts may also require the tenant to pay a security deposit. Usually, both the amounts depend on the type and size of the underlying property. Both are also a part of the lease contract, which tenants and landlords sign before beginning their relationship.

The company can make the journal entry for the rent paid in advance by debiting the prepaid rent account and crediting the cash account. Under ASC 842 base rent is included in the establishment of the lease liability and ROU asset. The amortization of the lease liability and the depreciation of the ROU asset are combined to make up the straight-line lease expense. Similarly to ASC 840, this straight-line lease expense is calculated as the sum of all of the rent payments over the lease term and divided by the total number of periods. A full example with journal entries of accounting for an operating lease under the new accounting standards can be found here. Lease payments decrease the lease liability and accrued interest of the lease liability.

Once that period is over, it becomes an expense for the tenant while the landlord receives an income. However, security deposits cover the whole length of the contract. Once that period is over, the landlord repays this deposit to the tenant. It represents an amount paid to a landlord for the future use of a property. In some circumstances, rent payments occur on a prepayment basis.

Prepaid expenses are not recorded on an income statement initially. Instead, prepaid expenses are first recorded on the balance sheet; then, as the benefit of the prepaid expense is realized, or as the expense is incurred, it is recognized on the income statement. Advance rent is an amount paid to a landlord in exchange for the use of their property for a specific period.

Overall, advance rent is a payment that falls before the start of a period. However, these payments may also be subject to the contract between a tenant and their landlord. These payments cover the period to which they relate, which must fall within the lease contract. It is also crucial to differentiate advance rent to understand whether it relates to the tenant or the landlord. When a tenant pays rent in advance, it does not constitute an expense.